My account

0 820 434 438

(0.18€/min + cost of call)

9am to 7pm - Mon. to Friday.

Good deals alert!

Subscribe to our newsletterTo discover also : Comprehensive insurance

Your ski insurance: €3.50 / day / person

ARTICLE 1

DEFINITIONS AND SCOPE OF APPLICATION

We, the Insurer

MUTUAIDE ASSISTANCE – 126, rue de la Piazza – CS 20010 – 93196 Noisy le Grand CEDEX. A public limited company with a registered share capital of €12,558,240 – A business governed by the French Insurance Code – Subject to the supervision of the French Prudential Supervision and Resolution Authority – 4 Place de Budapest, CS 92459, 75436 Paris Cedex 09 – 383 974 086 RCS Bobigny, France – VAT FR31 383 974 086.

Accident

Means a sudden and fortuitous event affecting the Insured, unintentional on their part, resulting from the sudden action of an external cause and having no connection with an accident or Illness prior to taking out the policy. The Accident must result in the Insured being unable to travel by their own means or to take part in a sports or leisure activity.

Serious bodily injury

Sudden and unforeseeable decline in health, due to an external cause that is unintentional on the part of the victim, noted by a competent medical authority and resulting in a prescription for medication to the patient and involving the cessation of all professional or other activities.

Sports or leisure activity

Refers to the practice, on an individual basis, of all sporting disciplines or activities undertaken as an amateur during a stay in the mountains when the ski resorts are open.

Insured

Refers to holders of a valid ski pass (valid for a maximum of 21 days), marketed by the ski lift companies, and who have subscribed to the insurance policy.

Holders of a valid pass who live outside the European Union, Switzerland, Great Britain, Monaco, the French overseas territories (COM), the French overseas departments and regions (DROM) or New Caledonia will only be entitled to insurance cover, and all assistance services are excluded.

Injury

Abrupt decline in health resulting from the sudden action of an external cause, which is not intentional on the part of the victim, noted by a competent medical authority.

COM

By COM we mean the French Overseas Territories, which include French Polynesia, Saint Pierre and Miquelon, Wallis and Futuna, Saint Martin and Saint-Barthelemy.

Definition of personal assistance

Personal assistance includes all the services implemented in the event of illness, injury or death of the persons covered, during covered travel.

Domicile

Refers to your main and usual place of residence, which appears as your domicile on your income tax notice. It is located anywhere in the world.

Holders of a valid pass who live outside the European Union, Switzerland, Great Britain, Monaco, the French overseas territories (COM), the French overseas departments and regions (DROM) or New Caledonia will only be entitled to insurance cover, and all assistance services are excluded.

DOM-ROM, COM and sui generis communities

Guadeloupe; Martinique, French Guiana, Reunion, French Polynesia, Saint Pierre and Miquelon, Wallis and Futuna, Mayotte, Saint Martin, Saint Barthelemy, New Caledonia.

DROM

By DROM we mean the Overseas Departments and Regions, namely Guadeloupe, Martinique, French Guiana, Reunion and Mayotte.

Duration of cover

The period of validity of the cover corresponds to the dates of the lift passes marketed by the ski lift companies, which may not exceed 21 days.

Abroad

All countries outside your country of domicile.

European Union

Austria, Belgium, Bulgaria, Cyprus, Croatia, Denmark, Czech Republic, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Events covered for assistance

Illness, injury or death during a covered trip.

Events covered for insurance

✓ Search and rescue costs

✓ Initial transport costs

✓ Secondary transport costs

✓ Interruption of sports or leisure activities

✓ Breakage of ski equipment

✓ Emergency medical costs following an accident during a sports or leisure activity in Metropolitan France

✓ DPRSA – Criminal defence and recourse cover following an accident – only for passes of two days or more.

Execution of services

The services covered by this agreement can only be triggered with prior approval from MUTUAIDE ASSISTANCE. Consequently, no expenditure made under the authority of the Insured will be reimbursed by MUTUAIDE ASSISTANCE.

Excess

Portion of the loss to be borne by the Insured as determined by the policy, in the event of compensation following a claim. The excess can be expressed as an amount, percentage, in days, hours, or kilometres.

Illness

Sudden unforeseeable decline in health noted by a competent medical authority.

Serious illness

Sudden and unforeseeable decline in health noted by a competent medical authority and resulting in a prescription for medication in the name of the ill person and involving the cessation of all professional or other activities.

Maximum per event

In the event that cover is exercised in favour of several insured victims of the same event insured under the same specific terms and conditions, the insurer’s cover is, in any event, limited to the maximum amount provided for under the cover, regardless of the number of victims. As a result, the indemnities are reduced and adjusted in proportion to the number of victims.

Family members

Your de facto or legal spouse or any person bound to you by a PACS (civil partnership), your ascendants or descendants or those of your spouse, your fathers-in-law, mothers-in-law, brothers, sisters, including the children of the spouse or live-in partner of one of your direct ascendants, brothers-in-law, sisters-inlaw, sons-in-law, daughters in-law, or those of your spouse. They must be domiciled in the same country as you unless otherwise stipulated in the policy.

We organise

We take the necessary steps to give you access to the service.

We pay for

We pay for the service.

Invalidity

Any fraud, falsification, false declaration or false testimony that could trigger the cover provided for in the policy will render our commitments and undertakings null and void and forfeit the rights specified in the aforementioned policy.

Claim

Event of a random nature that triggers cover under this policy.

Territoriality

All the cover defined below applies in France and neighbouring countries (subject to common ski areas).

ARTICLE 2

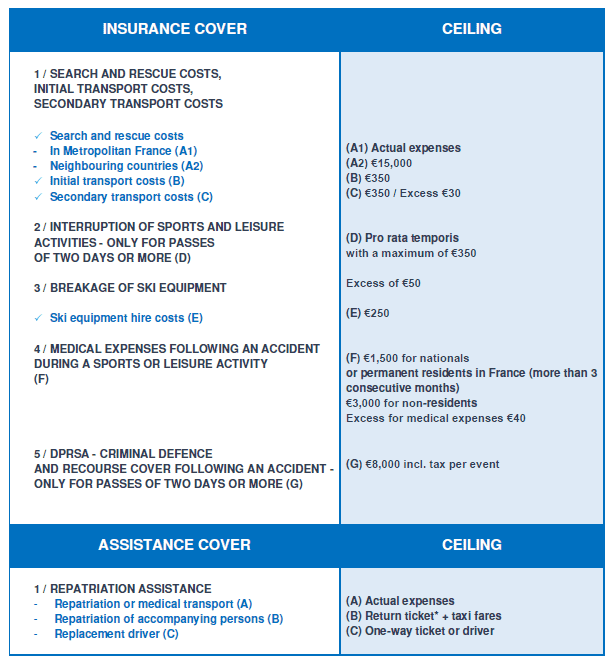

DESCRIPTION OF INSURANCE COVER

1 / SEARCH AND RESCUE COSTS, INITIAL TRANSPORT COSTS,

SECONDARY TRANSPORT COSTS

MOUNTAIN SEARCH AND RESCUE COSTS

• In the context of a sports or leisure activity, We will reimburse search costs and, in the event of an Accident, mountain rescue costs, including by helicopter (including off-piste skiing), up to the amount indicated in the Table of Cover Amounts.

• Only costs invoiced by a company duly approved for these activities can be reimbursed.

INITIAL TRANSPORT COSTS

In the context of a sports or leisure activity, We will reimburse, up to the amount indicated in the Table of Cover Amounts, in the event of an Accident, the cost of the Insured’s initial transport from the place ofthe Accident to the nearest medical centre able to provide first aid and return to the beneficiary’s place ofstay on the day of the Accident.

• In the event of helicopter rescue, the intervention will be considered as search and rescue costs with reference to Article 1.1.

• The cover is extended to evacuation directly from the site of the Accident to a medical centre outside the resort solely in the event of an emergency or medical necessity.

SECONDARY TRANSPORT COSTS

In the context of a sports or leisure activity, We will reimburse, up to the amount indicated in the Table of Cover Amounts, the costs corresponding to the transfer from the resort and/or a hospital to a moresuitable medical centre and the costs of returning to the Insured’s place of stay on the day of theAccident.

• An Excess, the amount of which is indicated in the Table of Cover Amounts, is applied in all cases per Insured and for the duration of the policy.

2 / INTERRUPTION OF SPORTS AND LEISURE ACTIVITIES – ONLY

FOR PASSES OF TWO DAYS OR MORE

WHAT WE COVER

We will reimburse You pro rata temporis, up to the amounts indicated in the Table of Cover Amounts, for the cost of lift passes and/or ski lessons already paid for and not used, if You have to stop taking partin these activities for one of the following reasons:

• An accident in the ski area during ski lift opening hours which, in the opinion of a medical doctor, prohibits the practice of the sports and leisure activity and is demonstrated by the presentation of a detailed medical certificate,

• Illness with unforeseen hospitalisation of the Insured, lasting more than 24 consecutive hours, involving the prohibition of skiing until the end of the stay.

Any day partially used will not be reimbursed.

HOW MUCH DO WE COVER?

The indemnity is:

An excess, the amount of which is indicated in the Table of Cover Amounts, is applied in all cases per Insured and for the duration of the policy. The following are not taken into account in the calculation of the indemnity: administration and insurance costs, as well as reimbursements or compensation granted by the organisation from which You purchased your activity package.

WHAT ARE YOUR OBLIGATIONS IN THE EVENT OF A CLAIM?

Your claim must be supported by:

LIMITATION OF COVER

The cover is limited to one Claim per person.

WHAT WE EXCLUDE

In addition to the general exclusions applicable to the policy and set out in the paragraph “WHAT ARE THE GENERAL EXCLUSIONS APPLICABLE TO THE POLICY?” in the “FRAMEWORK OF THE POLICY” section, the following are excluded:

• the consequences of an epidemic or pandemic of any contagious infectious disease, including from a new

strain, recognised by the World Health Organization (WHO) or any competent authority of the country of

Domicile or of any Foreign country which should be visited or crossed during the Stay.

• • the consequences of quarantine and/or travel restrictions decided by a competent authority, which could

affect the Insured parties (Insured and/or their companion) before or during their Stay

3 / BREAKAGE OF SKI EQUIPMENT

We cover, up to the amount indicated in the Table of Cover, reimbursement of the cost of hiring equivalent

replacement ski equipment from a professional hire company for a maximum of 8 days, if your own or hired

ski equipment becomes unusable as a result of accidental breakage.

Accidental breakage means any damage or destruction that is externally visible and impairs the proper

functioning of the ski equipment covered as a result of a fall or collision on the slopes.

Personal ski equipment means skis, snowboards, monoskis, snowshoes, poles and ski boots purchased

less than 5 years ago and owned by you.

WHAT WE EXCLUDE

In addition to the exclusions common to all cover, we cannot intervene in the following circumstances:

WHAT ARE YOUR OBLIGATIONS IN THE EVENT OF A CLAIM?

You will need to provide us with:

✓ a statement describing the circumstances of the claim,

✓ proof from a professional describing the nature and extent of the damage to your personal ski

equipment,

✓ the original purchase invoice for your personal ski equipment, dated within the last 5 years, or the

original ski hire invoice,

✓ the rental invoice for the replacement ski equipment,

Supporting documents should be sent to:

GRITCHEN AFFINITY – Insurance Department

27, rue Charles Durand

CS 70139

18 021 BOURGES CEDEX

4 / EMERGENCY MEDICAL EXPENSES FOLLOWING AN ACCIDENT DURING A

SPORTS OR LEISURE ACTIVITY

We will reimburse you for Medical and Hospitalisation Costs following a ski Accident, incurred in the resort or in the nearest care facilities, and which remain payable by the Insured after payment by Social Security and/or any other insurance or provident organisation.

We will only intervene once the reimbursements have been made by the aforementioned insurance organisations, minus any excess as indicated in the Table of Cover, and subject to us receiving originals of the proof of reimbursement from your insurance organisation.

In that case, we will reimburse the amount of the costs incurred up to the maximum amount indicated in the Table of Cover.

Should the insurance organisation to which you contribute not cover the medical costs incurred, we will reimburse the costs incurred within the limit of the amount indicated in the Table of Cover, provided that you provide us with the original invoices for your medical costs and the certificate of non-reimbursement issued by the insurance organisation.

Type of expenses eligible for reimbursement (subject to prior agreement):

✓ medical fees,

✓ cost of medication prescribed by a doctor or surgeon,

✓ cost of any ambulance prescribed by a doctor for transport to the nearest hospital and only in the event

that the insurance organisations refuse cover,

✓ hospitalisation costs, provided that you are deemed unfit for transport by decision of the Assistance doctors, taken after gathering information from the local doctor (hospitalisation costs incurred from the day on which we are able to repatriate you are not covered),

In order to preserve our subsequent rights, we reserve the right to ask you or your beneficiaries for a letter of undertaking committing you to taking the necessary steps with the health and social security bodies and reimbursing us for the sums received.

In the event that you fail to complete the procedures for payment with the insurance organisations within the time permitted, or if you fail to provide MUTUAIDE ASSISTANCE with the certificate of non-payment from these insurance organisations within the time permitted, under no circumstances will you be able to take advantage of the “medical expenses” benefit and you will have to reimburse all hospitalisation costs paid by MUTUAIDE ASSISTANCE, which will initiate, where necessary, any useful recovery procedures, the cost of which will be borne by you.

5 / DPRSA – CRIMINAL DEFENCE AND RECOURSE COVER FOLLOWING AN

ACCIDENT – ONLY FOR PASSES OF TWO DAYS OR MORE

Lexicon

For Criminal Defence and Recourse cover, the words below, where they begin with a capital letter, are defined as follows:

• Expenses: Any of the sums listed exhaustively in Article 695 of the French Code of Civil Procedure, such as: duties, taxes, fees or emoluments collected by the court secretariats other than those due on the deeds and documents produced by the parties in support of their claims, translation costs where these are made compulsory by the regulations, witness fees, the remuneration of technicians, disbursements subject to tariffs, the emoluments of public or ministerial officers and the remunerationof lawyers insofar as this is regulated and including pleading fees.

– Event: This is the Insured Event, i.e. the occurrence of any event or fact constituting a claim which You make or receive.

• Dispute: Conflict between You and a Third Party. This may be of an amicable or judicial nature, leading You to assert a right or resist a claim against a Third Party. There is no Dispute if You oppose the resolution of the disagreement without a legitimate reason.

• Claim: A Claim is considered to be the express or tacit refusal of a claim made or received by You.

• Third Party: Any person not involved in the policy.

5.1. OUR SERVICES

When You are faced with an insured Claim, We undertake:

• after examining the case in question, to advise You on the scope or consequences of the case in terms of your rights and obligations,

• whenever possible, to provide You with our assistance on an amicable basis, with a view to finding the solution that best suits your interests,

• if necessary, to pay the expenses required to exercise or defend your rights out of court or before the competent courts, in accordance with the conditions set out in Article 6.5 “Financial Cover”.

5.2. AREA OF INTERVENTION

We cover your legal defence and legal recourse in the following areas, with the exception of the exclusions defined in Article 6.3 “What We exclude”.

Accident and Travel Protection

We take care of defending your interests:

• as part of any claim for financial compensation for your loss if You are the victim of property damage or bodily injury involving the liability of a Third Party,

• before any criminal court if You are prosecuted as the perpetrator or co-perpetrator of an offence committed in connection with an Accident.

5.3. WHAT WE EXCLUDE

In addition to the exclusions set out in the policy, the “Legal Defence and Recourse” cover does not apply:

5.4. CONDITIONS OF COVER

In order for cover to apply, You must be up to date with the subscription and the Claim must satisfy

the following conditions:

• the date of the Claim must fall between the date on which cover takes effect and the date on which it expires,

• the date on which the Insured Event occurs must be after the date on which the cover takes effect.

• On the legal front:

– in defence, We will intervene before the courts of the country of the destination zone in which the cover applies,

– in recourse, We will intervene before any French court with territorial jurisdiction,

– in recourse only, the amount of your loss in principal must be at least equal to €275,

– You must have the necessary and sufficient evidence to demonstrate the reality of your loss before the court.

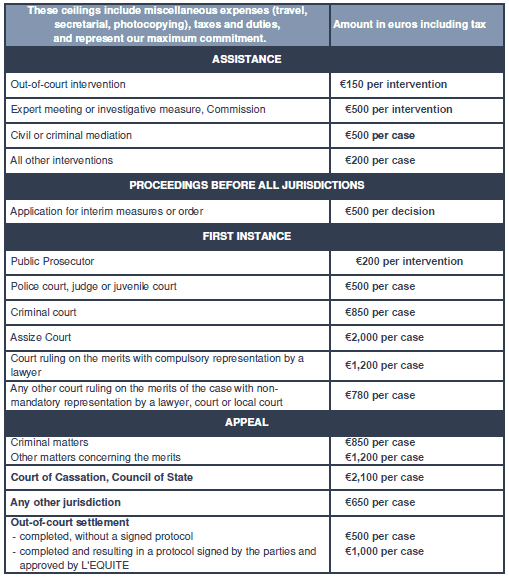

5.5. FINANCIAL COVER

COVERED EXPENSES

In the event of an insured Claim:

• on an amicable basis, We will pay the fees of an expert or specialist appointed by Us or by You with our prior and formal agreement, for a principal amount of loss at least equal to €275, up to a maximum per Claim of €1,000 inclusive of tax.

• in a judicial context, We will pay a maximum of €8,000 (including tax) per Claim, regardless of the number of beneficiaries:

– the costs of preparing the case file, such as bailiff’s fees incurred with our prior formal agreement,

– the taxable costs of a bailiff or legal expert appointed in your interest and whose intervention proves necessary to pursue the insured proceedings,

– non-taxable lawyers’ fees and expenses, as specified in the “Choice of Lawyer” section.

In the event of a legal settlement, the Insurer will pay the lawyer’s fees up to the limit of those that would have been applied if the proceedings had been brought to a conclusion.

NON-COVERED EXPENSES

The cover does not cover:

• the cost of legal advice or legal proceedings carried out before the Claim is reported, unless

You can prove the urgency of having incurred them previously,

• bailiff’s fees and emoluments,

• criminal deposits, criminal fines, tax fines, civil fines or any similar contributions.

• investigator’s fees and expenses,

The cover does not cover sums of any kind that You ultimately have to pay or reimburse to the opposing party, such as:

• principal, costs and interest, damages and penalty payments,

• Expenses,

• penalties imposed on you under Article 700 of the French Code of Civil Procedure, Articles 475- 1 or 800-1 or 800-2 of the French Code of Criminal Procedure, Article L761-1 of the French Code of Administrative Justice, or any other text that supplements or replaces them, or any other penalty of the same nature imposed by the court seised.

CHOICE OF LAWYER

In the event of a Claim, as well as in the event of a conflict of interest arising between Us in connection with the aforementioned Claim, You have the possibility of freely choosing the lawyer whose intervention proves necessary to settle, assist You or represent You in court. We must be notified immediately of any change of lawyer. You and the lawyer agree on the amount of the lawyer’s fees and expenses.

You are free to choose between the following options:

– If You use the services of your lawyer, You pay their fees and expenses directly to them. You may ask Us to reimburse the said costs and fees, up to the maximum amounts set out in Article 6.6 “Maximum amounts of cover – Legal fees”, as specified below. Indemnities will be paid within 4 weeks of receipt of proof of your claim. If you expressly request it, We can pay these sums directly to your lawyer within the same contractual limits.

If You have paid a retainer to your lawyer, We may reimburse it to You as an advance on the amount of

your indemnity. However, this advance payment may not exceed half the amount of the indemnities set out

in Article 6.6 “Maximum amounts of cover – Legal fees”. The balance of our indemnity will be paid at the end of the proceedings.

– If You request the assistance of our corresponding lawyer appointed by Us following a written request from You, provided that the Claim is within the jurisdiction of a French court or a court located in the territory of the European Union or Monaco, We will directly pay the costs and fees covered up to the maximum amounts set out in Article 6.6 “Maximum amounts of cover – Legal fees”, with any additional costs being borne by You. Please note: under penalty of non-payment of the contractual amounts, You must:

• Obtain our express agreement before making any settlement with the opposing party,

• Enclose receipted bills of fees together with full copies of all pleadings and rulings or the settlement agreement signed by the parties.

DIRECTION OF THE TRIAL

In the event of litigation, You, assisted by your lawyer, are responsible for directing, managing and monitoring the Claim.

5.6. MAXIMUM AMOUNTS OF COVER – LEGAL FEES

5.7. HOW THE COVER WORKS

MAKING A CLAIM

To enable Us to intervene effectively, You must make your declaration in writing as soon as possible to the insurer whose references are specified in the policy.

IMPLEMENTATION OF THE COVER

On receipt, your file will be processed as follows:

1 – We inform You of our position regarding the cover, it being understood that We may ask You to provide Us, without restriction or reservation, with all documents relating to the Dispute as well as any additional information in your possession.

In accordance with the provisions of Article L 127-7 of the French Insurance Code, We are bound by an obligation of professional secrecy.

2 – We give you our opinion on the advisability of settling or initiating legal proceedings, whether as plaintiff or defendant. Any disagreement on this subject will be settled in accordance with the terms and conditions set out in Article 6.8 “Arbitration”.

ACCUMULATION OF COVER

If You are covered by several policies for the risk which is the subject of our cover, You must inform Us of this, at the latest, when declaring the Claim. It is understood that You may contact the insurer of your choice to take charge of the Claim. Cover for policies taken out without fraud is effective within the contractual limits. If there has been deception or fraud on your part, the penalties set out in Article L 121-3 of the French Insurance Code will apply.

ENFORCEMENT OF COURT RULINGS AND SUBROGATION

As part of our cover, We will pay the costs of bailiffs, other than those referred to in Article 6.5. Financial Cover – “Non-Covered Expenses”, in order to enforce the court order made in your favour. If the opposing party is ordered to pay the costs of the proceedings, We are subrogated to your rights and actions, up to the amount that We have paid under this policy.

When You are awarded a procedural indemnity by application of the provisions of Article 700 of the French Code of Civil Procedure, Article 475-1 or 800-1 and 800-2 of the French Code of Criminal Procedure or Article L761-1 of the French Code of Administrative Justice or by any text providing for indemnities of an equivalent nature, this sum benefits You in priority for the expenses that remain payable by You, and then reverts to Us up to the limit of the sums that We have indemnified.

FORFEITURE OF COVER

You may forfeit your right to cover:

• if You make inaccurate statements in bad faith concerning the facts or events giving rise to the claim, or more generally, concerning any element that could be used to resolve the Dispute,

• if You intentionally use or produce inaccurate or fraudulent documents,

• if You settle with the opposing party without our express prior agreement.

5.8. ARBITRATION

In accordance with the provisions of Article L127-4 of the French Insurance Code, in the event of disagreement between You and Us concerning the measures to be taken to settle the Dispute which is the subject of the insured Claim, it may be submitted to arbitration by a third party appointed by mutual agreement between the parties, or failing this, by the President of the High Court with territorial jurisdiction, ruling in summary proceedings. The costs incurred in exercising this right will be borne by us, unless the President of the High Court decides otherwise on the grounds that your application is unreasonable. If, contrary to our advice and/or that of the third party, You initiate legal proceedings at your own expense and obtain a more favourable solution than ours or that proposed by the third party, We undertake, as part of your cover, to pay the legal costs that You have thus incurred, in accordance with Article 6.5 “Financial cover”.

Nevertheless, in order to simplify the management of this disagreement, if You have asked a person who is legally authorised to give legal advice on the measures to be taken to settle the Dispute which is the subject of the insured Claim, We undertake to rely on the opinion of this person. In this case, We will pay the consultation fees of this person within the contractual limit of the table “Maximum amounts of cover – Legal fees” which appears in the specific provisions for the item “Assistance- Civil Mediation”.

5.9. CONFLICT OF INTEREST

If, at the time of reporting the Claim, or during the course of the Claim, a conflict of interest arises betweenYou and Us, in particular when the Dispute is between Us or another of its Insured parties, You may be assisted by a lawyer chosen in accordance with the provisions of Article 6.5. Financial Cover – “Choice of Lawyer”. You may also have recourse to the arbitration procedure defined in Article 6.8 “Arbitration”

ARTICLE 3

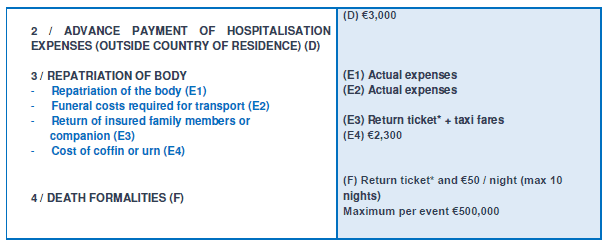

DESCRIPTION OF PERSONAL ASSISTANCE COVER

You are ill, injured or die during a covered trip. We intervene under the following conditions:

1 / REPATRIATION OR MEDICAL TRANSPORT

You are ill or injured during a covered trip. We organise and take care of your repatriation to your home or to a hospital near you.

In determining the date of your repatriation, the choice of transport or place of hospitalisation, only medical requirements are taken into account. Any decision to repatriate is taken by our medical consultant, after consulting the temporary treating doctor and potentially your family doctor. During your repatriation, and as recommended by our medical consultant, we organise and pay for the transport of a person to be by your side.

Any refusal of the solution offered by our medical team will render the personal assistance cover null and void.

Repatriation of accompanying persons

You are repatriated medically by us, on the advice of our medical adviser, during an insured trip. If they are unable to return by the means initially planned, we will organise and pay for transport to the home of your beneficiary family members or an insured person accompanying you when the event occurs,by 1st class train or economy class airliner, as well as taxi fares, on departure, so that they can get from their place of travel to the station or airport, and on arrival, from the station/airport to the Domicile.

Replacement driver

You are ill or injured during a covered trip in one of the countries listed below and you are no longer able to drive your vehicle: if none of the passengers is able to replace you, we will provide a driver to take the vehicle back to your place of residence by the most direct route.

We cover the driver’s travel costs and wages.

The driver is required to comply with labour legislation, and in particular must – as French regulations currently stand – take a 45-minute break after 4 hours 30 minutes of driving, the total daily driving time not to exceed 9 hours.

If your vehicle is more than 8 years old and/or has done more than 150,000 km, or if its condition and/orload does not comply with the standards laid down by the French Highway Code, you should let us know. We reserve the right not to send a driver. In this case, as an alternative to providing a driver, we will provide and pay for a 1st class train ticket or an economy class plane ticket to collect the vehicle.

This service only applies in the following countries: France (including Monaco, Andorra, except DOM-ROM, COM and sui generis communities), Spain, Portugal, Greece, Italy, Switzerland, Liechtenstein, Austria, Germany, Belgium, Netherlands, Luxembourg,United Kingdom, Ireland, Denmark, Norway, Sweden, Finland, Iceland).

The cost of fuel, tolls, hotels and meals for any passengers remains your responsibility.

2 / ADVANCE PAYMENT OF HOSPITALISATION EXPENSES (OUTSIDE COUNTRY

OF RESIDENCE)

For the purposes of this benefit, the term “France” means Metropolitan France, the Principality of Monacoand the French overseas departments and territories. Insured persons domiciled in a DROM will not beconsidered as travelling abroad when they travel to Metropolitan France or the Principality of Monaco and vice versa.

You are ill or injured during your stay abroad, and for as long as You are hospitalised, We can advance thecost of hospitalisation up to the amounts indicated in the Table of Cover Amounts.

This advance will be made subject to the following cumulative conditions:

• for treatment prescribed in agreement with our doctors,

• as long as they deem You untransportable after obtaining information from the local doctor.

No advance is granted from the day on which We are able to carry out the transport, even if You decide to stay on site.

In all cases, You undertake to reimburse Us for this advance no later than 30 days after receipt of our invoice. In the event of non-payment on your part by this date, the Policyholder undertakes to reimburse Us for this advance within a maximum of 30 days of our request, with the latter being responsible for recovering the amount, if they so wish, from You.

In order to be reimbursed, you must then take the necessary steps to recover your medical expenses from the relevant organisations.

This obligation applies even if You have initiated the reimbursement procedures referred to above.

3 / REPATRIATION OF THE BODY

You die during your stay. We organise the repatriation of your body to the place of burial in your country of

residence.

In this context, we are responsible for:

✓ The cost of transporting the body,

✓ Expenses relating to conservation care required by the applicable legislation,

✓ Expenses directly necessitated by the transport of the body (handling, specific transport

arrangements, cost of coffin or urn, packaging) up to the amount indicated in the Table of Cover.

All other costs (notably ceremonies, local convoys, burial) remain the responsibility of the family.

We organise and pay for the return, by 1st class train or economy class plane and, where applicable, the

cost of a taxi on departure and arrival, of an insured person or insured family members who were staying

with the deceased so that they can attend the funeral, if the means initially planned for their return to the

country of Domicile cannot be used.

4 / DEATH FORMALITIES

If the presence on site of a member of the family or a close relative of the deceased is essential in order to

identify the body and carry out the formalities for repatriation or cremation, we will organise and pay for a

return ticket by 1st class train or economy class airliner, as well as the accommodation costs (room and

breakfast) incurred on behalf of this person up to the amount indicated in the Table of Cover.

All other costs remain the responsibility of the family of the deceased.

ARTICLE 4

EXCLUSIONS FROM PERSONAL ASSISTANCE

We will not intervene for:

– Travel undertaken for the purpose of diagnosis and/or treatment,

ARTICLE 5

GENERAL EXCLUSIONS

We will not intervene for:

– Services which have not been requested during the trip or which have not been organized by us, or in agreement with us, do not give the right, retrospectively, to reimbursement or indemnity,

– Dining and hotel expenses, except those specified in the description of cover,

– Damage intentionally caused by the Insured and damage resulting from their participation in a crime, offence or an altercation, except in the case of self-defence,

– The amount of any conviction and any consequences thereof,

– The use of narcotics or drugs not prescribed medically,

– The state of alcoholic intoxication,

– Customs duties,

– Participation as a competitor in a competitive sport or a rally giving the right to national or international ranking which is organised by a sports federation for which a licence is issued, as well as training for these competitions,

– The professional practice of any sport,

– Participation in competitions or endurance or speed tests and their preparatory tests, aboard any land, water or air locomotion vehicle,

– The consequences of non-compliance with recognised safety rules related to the practice of any leisure sporting activity,

– Expenses incurred after returning from the trip or expiry of the cover,

– Accidents resulting from your participation, even as an amateur, in the following sports: motor sports (regardless of the motorised vehicle used), air sports, high mountain mountaineering, bobsleigh, hunting of dangerous animals, ice hockey, skeleton, combat sports, caving, snow sports with an international, national or regional classification,

– Voluntary failure to comply with the regulations of the country visited or the practice of activities that are not authorised by the local authorities,

– Official prohibitions, seizures or constraints by the public authorities,

– Use by the Insured of air navigation instruments,

– The use of war devices, explosives and firearms,

– Damage resulting from wilful or intentional misconduct by the Insured as set out in Article L.113-1 of the French Insurance Code,

– Suicide and attempted suicide,

– Epidemics and pandemics, pollution and natural disasters,

– Civil or foreign war, riots, strikes, popular protests, acts of terrorism, hostage-taking,

– Disintegration of an atomic nucleus or any irradiation coming from a source of radioactive energy.

Under no circumstances shall the liability of MUTUAIDE ASSISTANCE be engaged for breaches or setbacks in the performance of its obligations resulting from cases of force majeure, or due to events such as civil or foreign war, riots or popular movements, lockouts, strikes, attacks, acts of terrorism, piracy, storms and hurricanes, earthquakes, cyclones, volcanic eruptions or other cataclysms, the disintegration of an atomic nucleus, the explosion of radioactive nuclear devices and the effects, epidemics, the effects of pollution and natural disasters, the effects of radiation or any other fortuitous or force majeure event, and their consequences.

ARTICLE 6

OPERATING RULES FOR ASSISTANCE SERVICES

Only a telephone call from the Insured at the time of the incident will enable the use of assistance services.

Upon receiving the call, MUTUAIDE ASSISTANCE will, once it has verified the rights of the requesting person, organise and pay for the services provided for in this policy. To benefit from a service, MUTUAIDE ASSISTANCE may ask the Insured to justify the status they are asserting and to produce, at their own expense, any documents demonstrating this right.

The Insured must allow our doctors access to any medical information concerning the person for whom we

are intervening. This information will be processed in accordance with medical confidentiality.

MUTUAIDE ASSISTANCE can in no way replace the local emergency aid organisations and intervenes within the limits of agreements given by the local authorities, nor can it cover the costs thus incurred, with the exception of the costs of transport by ambulance or by taxi to the nearest place where appropriate care can be provided, in the event of mild illness or minor injuries that do not require repatriation or medical transport.

The interventions that MUTUAIDE ASSISTANCE is required to perform are conducted in full compliance with national and international laws and regulations. They are, therefore, reliant on obtaining the necessary authorisations from the competent authorities.

When MUTUAIDE ASSISTANCE has paid for the transport of the Insured, that person must return their unused scheduled return ticket.

MUTUAIDE ASSISTANCE decides on the nature of the air ticketing made available to the Insured

according to the possibilities offered by airlines and the duration of the journey.

ARTICLE 7

CONDITIONS OF REIMBURSEMENT

We can only refund the Insured upon presentation of the original paid invoices that correspond to the costs

incurred with our approval.

Reimbursement requests should be sent to:

MUTUAIDE ASSISTANCE

Claims Management Department

126, rue de la Piazza – CS 20010 – 93196 Noisy le Grand CEDEX

ARTICLE 8

COMPLAINT HANDLING

9.1 A complaint is an oral or written expression of dissatisfaction with a professional. A request for a service, information or advice is not a complaint.

If you have any complaints about your assistance cover, you can contact MUTUAIDE by calling 01.48.82.63.44.

If your verbal complaint is not resolved to your satisfaction, we invite you to write to us, either by email to

[email protected] or by post to

MUTUAIDE

CUSTOMER QUALITY DEPARTMENT

126, rue de la Piazza – CS 20010 – 93196 Noisy le Grand CEDEX

In the event of a written complaint, we will acknowledge receipt within a maximum of 10 working days from

the date of dispatch.

Our response must be sent to you in writing no later than two months after the complaint is sent.

If you are not satisfied with this response, or if you have not received a response within two months, you have the right to refer the matter to Médiation de l’Assurance (the Insurance Ombudsman) on the following website www.mediation-assurance.org or by post (Médiation de l’Assurance TSA 50110, 75441 Paris Cedex 09), without prejudice to your right to take your case to court.

9.2 A complaint is an oral or written expression of dissatisfaction with a professional. A request for

a service, information or advice is not a complaint.

If you have any complaints about your insurance cover, please contact GRITCHEN AFFINITY by email to [email protected] or by post to

GRITCHEN AFFINITY – Complaints Department

27, rue Charles Durand

CS 70139 – 18021 BOURGES CEDEX

In the event of a written complaint, we will acknowledge receipt within a maximum of 10 working days from

the date of dispatch.

Our response must be sent to you in writing no later than two months after the complaint is sent.

If you are not satisfied with this response, or if you have not received a response within two months, you

have the right to refer the matter to Médiation de l’Assurance (the Insurance Ombudsman) on the following

website www.mediation-assurance.org or by post (Médiation de l’Assurance TSA 50110, 75441 Paris

Cedex 09), without prejudice to your right to take your case to court.

ARTICLE 9

DATA COLLECTION

The Insured hereby acknowledges being informed that the Insurer processes their personal data in accordance with regulations relating to the protection of personal data in effect and that, moreover:

– Answers to the questions asked are obligatory and in the event of false declarations or omissions, the consequences for the Insured may be that the policy taken out is invalid (Article L 113-8 of the French Insurance Code) or the indemnities are lower (Article L 113-9 of the French Insurance Code),

• The processing of personal data is necessary for acceptance and execution of the Insured’s policy and cover, the management of commercial and contractual relationships and the execution of legal, regulatory or administrative provisions in effect.

• The data collected and processed is kept for the period necessary for execution of the policy or the legal obligation. This data is then archived in accordance with the timeframes specified by the provisions relating to time limits.

• The recipients of the Insured’s personal data are, within the limits of their remit, the Insurer’s departments in charge of the signature, management and execution of the Insurance Policy and cover, its delegates, agents, partners, sub-contractors and reinsurers, within the framework of their duties. This data can also be sent, where necessary, to professional bodies as well as to all persons involved in the policy such as lawyers, experts, court officials and ministerial officers, trustees, guardians or investigators. Information concerning the Insured may also be transmitted to the Underwriter, as well as to all persons accredited as Authorised Third Parties (courts, arbitrators, mediators, relevant ministries, supervisory and regulatory authorities and all public bodies authorised to receive it, as well as departments in charge of control such as statutory auditors, auditors and departments in charge of internal control).

• In its capacity as a financial organisation, the Insurer is subject to the legal obligations resulting mainly from the French Monetary and Financial Code with regard to money laundering and against the financing of terrorism and as such it monitors policies, which could result in drafting a declaration of suspicion or freezing assets.

Data and documents concerning the Insured are kept for a period of five (5) years from the end of the policy or termination of the relationship.

• The Insured’s personal data may also be used within the context of data processing to combat insurance fraud, which may lead, if applicable, to registration on a list of persons presenting a risk of fraud. This registration could have the effect of extending verification of the Insured’s claim, or even the reduction or refusal of the benefit of a right, benefit, policy or service offered. In this context, personal data concerning the Insured (or concerning persons or parties with an interest in the policy) may be processed by any authorised person working within the entities of the Insurer Group in the context of combatting fraud. This data may also be intended for authorised personnel of organisations directly concerned by fraud (other insurance organisations or intermediaries; judicial authorities, mediators, arbitrators, court officials, ministerial officers; third party organisations authorised by a legal provision and, where applicable, victims of acts of fraud or their representatives). In the event of a fraud alert, the data is kept for a maximum of six (6) months to qualify the alert and then deleted, unless the alert appears to be meaningful. In the event of a meaningful alert, the data is kept for up to five (5) years from when the fraud file is closed, or until the end of the legal proceedings and the applicable limitation periods.

The data of people registered on a list of suspected frauds is deleted after five years from being registered on this list.

• In its capacity as Insurer, it is entitled to process data relating to violations, convictions and safety measures, either when the policy is taken out, or during the period of execution, or within the context of managing any litigation.

• Personal data may be used by the Insurer for its processing operations with the purpose of research and

development to improve the quality or relevance of its future insurance or assistance products and service

offers.

• The Insured’s personal data may be accessible to some of the Insurer’s employees or service providers established in countries outside the European Union.

• Upon proof of identity, the Insured has a right of access, rectification, deletion and objection concerning the data processed. The Insured also has the right to ask to limit the use of their data when no longer necessary, or to recover, in a structured format, the data that they provided when necessary for the policy or when they consented to the use of that data.

The Insured has the right to provide instructions on what should be done with their personal data upon their death. These instructions, whether general or specific, concern the storage, removal and communication of the Insured’s data after their death. These rights can be exercised with the Data Protection Representative for the Insured’s Data:

By email:

or by post:

Data Protection Representative

MUTUAIDE ASSISTANCE

126, rue de la Piazza

CS 20010

93196 Noisy le Grand CEDEX

If the Insured makes a request to the Data Protection Representative that is not concluded satisfactorily, the Insured may contact the CNIL (French Data Protection Agency)

ARTICLE 10

SUBROGATION

MUTUAIDE ASSISTANCE is subrogated, to the extent of the indemnities paid and the services provided by it, in the rights and actions of the Beneficiary against any person responsible for the facts which justified its intervention. When the services provided in execution of the agreement are fully or partially covered by another company or institution, MUTUAIDE ASSISTANCE is subrogated in the rights and actions of the beneficiary against that company or institution.

ARTICLE 11

TIME LIMITS

In application of Article L 114-1 of the French Insurance Code, actions resulting from this policy must be brought within two years of the event giving rise to it. That period is extended to ten years for death cover, when beneficiaries must act within a maximum of thirty years after that event.

However, this time limit only runs:

• in the event of reticence, omission, false or inaccurate statement on the risk incurred, from the day that the Insurer became aware of it;

• in the event of a loss, from the day that the concerned parties became aware of it, provided they can demonstrate that they were unaware of it until then. When the action of the Insured against the Insurer is due to the recourse of a third party, this time limit only starts from the day upon which the third party brought legal proceedings against the Insured or was indemnified by the Insured.

This time limit may be interrupted, in accordance with Article L 114-2 of the French Insurance Code, by one of the following ordinary causes of interruption:

• recognition by the debtor of the right of the party against whom the time limit was reached (Article 2240 of the French Civil Code);

• legal action, even in summary proceedings, until termination of the proceedings. The same applies when it is brought before a court that does not have jurisdiction or when the act of referral to the court is nullified by the effect of a procedural defect (Articles 2241 and 2242 of the French Civil Code). The interruption is void if the petitioner withdraws the request or allows the procedure to expire, or if the petitioner’s request is definitively rejected (Article 2243 of the French Civil Code);

• a protective measure taken in application of the French Code of Civil Enforcement Procedures or an act of forced execution (Article 2244 of the French Civil Code).

You are reminded that:

Notification made to one of the joint debtors in respect of legal proceedings or an act of forced execution, or recognition by the debtor of the right of the party against whom the time limit had expired, interrupts the time limit against all the others, even against their heirs.

However, notification to one of the heirs of a joint debtor or the recognition of this heir does not interrupt the time limit with regard to the other joint heirs, even in the event of a mortgage claim, if the obligation is divisible. This notification or recognition only interrupts the time limit in respect of the other co-debtors, for the part owed by that heir. To interrupt the time limit period in its entirety in respect of the other co-debtors, all the heirs of the deceased

debtor must be notified, or all the heirs must be acknowledged as such (Article 2245 of the French Civil

Code).

Notification made to the principal debtor or their acknowledgment shall interrupt the time limit against the surety (Article 2246 of the French Civil Code). The time limits can also be interrupted by:

• the appointment of an expert following a claim;

• sending a registered letter with acknowledgement of receipt (sent by the Insurer to the Insured regarding the action for payment of the premium and sent by the Insured to the Insurer regarding settlement of the claim indemnity).

ARTICLE 12

DISPUTE SETTLEMENT

Any differences arising between the Insurer and the Insured relating to the determination and payment of benefits will be submitted by the first party to take action, failing amicable resolution, to the competent court at the domicile of the beneficiary in accordance with the provisions of Article R 114-1 of the French Insurance Code.

ARTICLE 13

FALSE DECLARATIONS

When they change the subject of the risk or reduce our opinion of it:

• Any reluctance or intentionally false declaration on your part will render the policy null and void. We shall retain any premiums paid and we shall be entitled to demand payment of any premiums due, as provided for in Article L 113.8 of the French Insurance Code.

• Any omission or inaccurate declaration by you for which bad faith is not established will result in the termination of the policy ten days after the notification is sent to you by registered letter and/or the application of the reduction in indemnities under the French Insurance Code, as set out in Article L 113.9.

ARTICLE 14

REGULATORY AUTHORITY

The authority responsible for monitoring MUTUAIDE ASSISTANCE is the Autorité de Contrôle Prudentiel et de Résolution (ACPR, Prudential Supervision and Resolution Authority)

4, place de Budapest – CS 92 459 – 75 436 Paris Cedex 9.

GRITCHEN AFFINITY INSURANCE DEPARTMENT – Claims Department

27, rue Charles Durand – CS 70139

18 021 BOURGES CEDEX

• by email: [email protected]

• online: http://declare.fr

Gather the following information, which you will be asked to provide when you call:

• Your insurance policy number,

• Your surname and first name,

• Your home address,

• A telephone number at which we can reach you,

• The reason for your declaration.

During the first call, you will be given an insurance file number. Always refer to this in all subsequent dealings with our Insurance Department.

MUTUAIDE ASSISTANCE ASSISTANCE DEPARTMENT

126, rue de la Piazza – CS 20010 – 93196 Noisy le Grand CEDEX

7 days a week – 24 hours a day

• by telephone from France: 01.48.82.63.44 (Standard rates apply, as determined by the operator; call may be recorded)

• by telephone from abroad: 33.1.48.82.63.44 preceded by the local access code to the international network

(Standard rates apply, as determined by the operator; call may be recorded)

• by fax: 01. 45.16.63.92

• by email: [email protected] Gather the following information, which you will be asked to provide when you call:

• Your insurance policy number,

• Your surname and first name,

• Your home address,

• The country, city or location where you are calling from,

• Your precise address (street name and number, hotel, etc.),

• A telephone number at which we can reach you,

• The nature of your problem.

During the first call, you will be given an assistance file number. Always refer to this in all subsequent dealings with our Assistance Department.